With Fraud Filter merchants can design their own fraud system.

If a payment is marked as “Possible fraud” it does not necessarily mean that it is fraud, and a payment that is not marked cannot be seen as “Safe”. As a merchant you must always assess and examine payments that for some reason may seem suspicious.

Please note that a payment also may be affected by rules from an acquirer. We will look at them at the end of the article.

In Settings > Fraud Filter it is possible to view the current rulesets, and setup new ones.

All merchants are created with a default ruleset, that marks payments with a fraud score above 50 with a flag for possible fraud.

It is possible to filter payments by the following rules

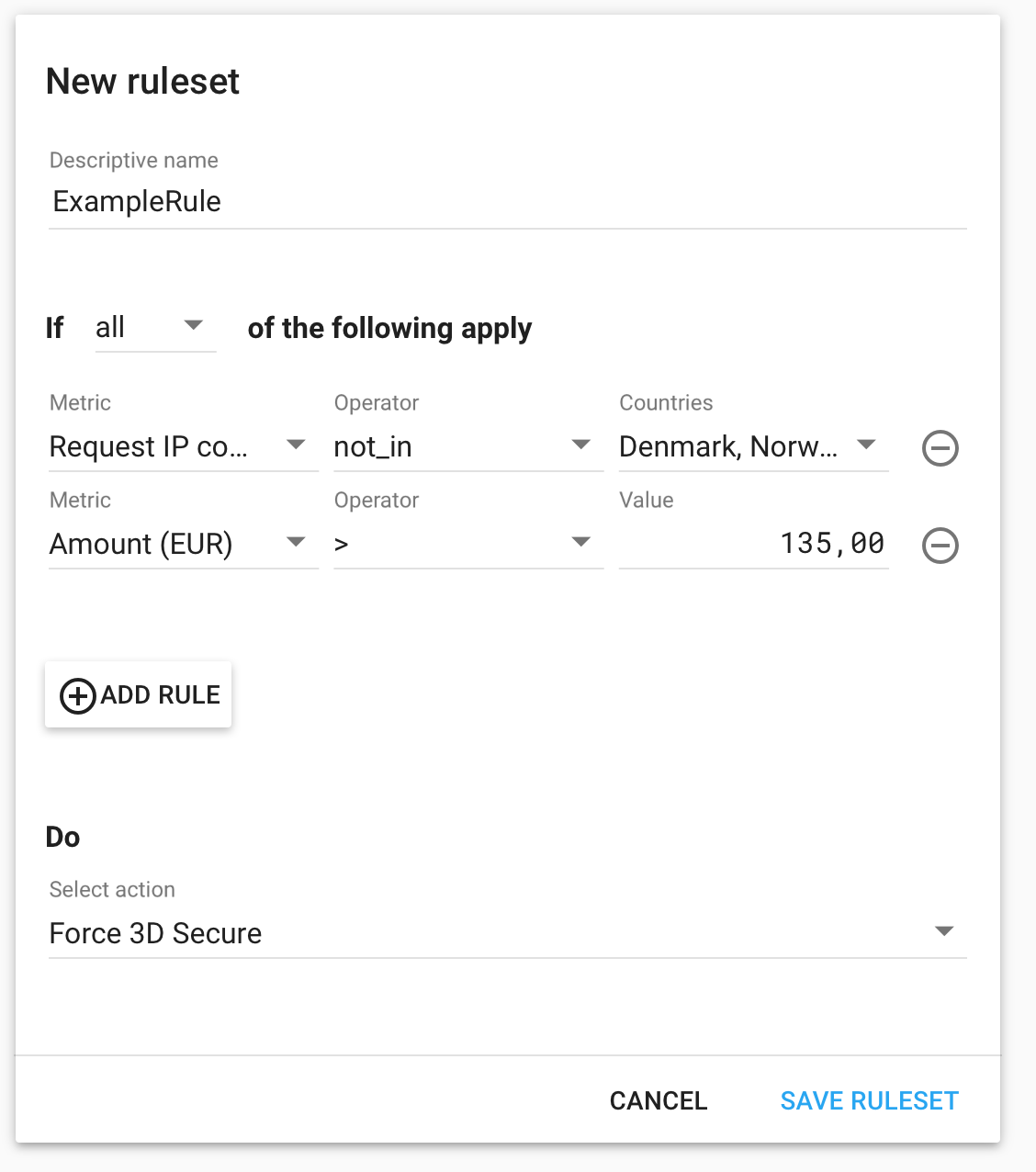

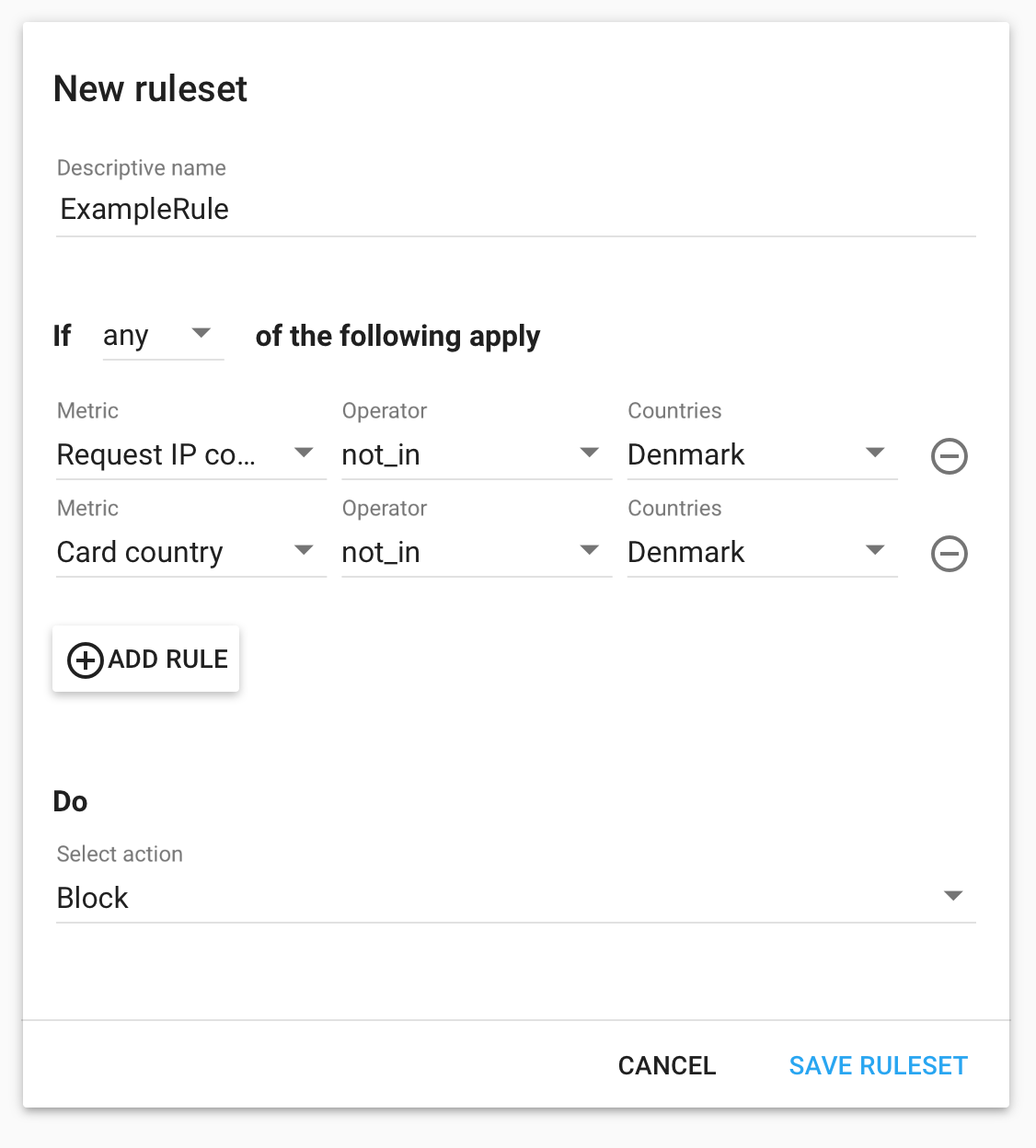

A ruleset can be contain one or more rules. And it can be selected if the action should happen if only one or all of the rules are triggered. See examples

If a payment gets caught by a ruleset, it is possible to take the following actions on the payment:

Mark as possible fraud: Payments will be marked with a “possible fraud”-flag in our system, and can now manually be assessed.

Force 3-D Secure: The payment will automatically be forced through 3-D Secure.

Block payment: The payment is blocked

It is also possible to set action to “Nothing”, in case you wish to disable the rule for a period of time.

All payments through Quickpay are analysed by a system, that looks at different parameters and then gives them a fraud score between 0 and 100.

Per default all payments with a score above 50 are marked as possbile fraud.

Parameters include

Amount - both on the transaction and the total amount on the card from the last 24 hours

Amount of transactions on the card or IP within a period

Issuer country and cardholder country

In addition to the above, the transaction is compared to previous transactions that have been confirmed as fraud by other merchants.

Please note that all payments above 300 EUR, automatically will get a fraud score of 100.

Amount on the payment. Specified in EUR.

The country that the card has been issued in.

The country where the card is used.

In the following section you can see some examples of rules.

Payments through Nets that get a fraud score above 50 are automatically escalated to 3-D Secure.

If Secured By Nets is activated on your account, all Dankort payments will automatically pass through Secured By Nets.

Nets assesses the payment to see if cardholder must use 2-factor-authentication to complete the payment.

Read more about Secured by Nets

All agreements from Clearhaus have certain rules that determines how the agreement can be used.

These rules can be found under Settings > Acquirers > Clearhaus, once you have input your Clearhaus API Key.