Nets is responsible for Dankort, Payment Services, NemID, international payment cards and more. When it comes to debit cards, payment services and secure digital data communications, Nets is a part of the Danes everyday

Nets is also an acquirer for internet transactions. On credit cards like VISA, Mastercard, American Express, etc. there are many different acquirers, but when it comes to Dankort, Nets has monopoly. This means, that Nets is the only acquirer that can handle payments with Dankort. Do you have en internet shop that is represented on the Danish market and you want to use Dankort, you must have an agreement with Nets.

Nets only has licence to make merchant agreements within Europe. If you want to know if you can get an agreement, please contact Nets.

A merchant agreement with Nets is made between you as a shop (merchant) and the selected acquirer. On the international market, there is many different acquirers, that can handle transactions made with credit cards like VISA, Mastercard, American Express, etc. But Nets has monopoly for Dankort. Do you have en internet shop that is represented on the Danish market and you want to use Dankort, you must have an agreement with Nets. Nets does also support many different int. credit cards, therefore Nets is the obvious choice for Danish internet shops (merchants).

Please be aware that Nets operates with two different agreement types. One that only supports Dankort and eDankort and an agreement that support all other credit cards (international credit credit cards).

From the start of may 2016, all payments processed by Teller has been a subject to SecurePay.

With SecurePay you ensure that your payments follow the new rules from the EU, to reduce fraud in online shopping.

Our Fraud filter will automatically run for every merchant, therefor no action is nescesarry in order to activate it.

In cooperation with Teller we have adjusted our own fraud filter, så it supports options, which in short terms works as such:

All payment under 200 DKK/30 EUR, will not be a subject to SecurePay and will be processed as normal.

All payments from 2000 DKK/300 EUR(per card per day) and up will automatically be forced through 3-D Secure.

Payments between 200 and 2000 DKK will automatically be assessed by our fraud filter on different parametres. If our system suspects fraud, the payment will be forced through 3-D Secure, to reduce the possibility of fraud.

Our fraud filters assessment will happen without the customer noticing it, and there is no delay before the transaction goes to 3-D Secure.

If a payment is selected by securepay to go through 3-D Secure, a message will appear on the transaction saying: 3-D Secure is required due to SecurePay

It is also possible force all payments through 3-D Secure, and thereby bypass the SecurePay assessment.

Clearhaus

For now the SecurePay rules are not valid for Clearhaus, because Clearhaus assesses all transactions themselves. However, it is possible that payments to Clearhaus within the near future will be passed through our fraud filter, and possibly will be selected for 3-D Secure.

Dankort

Dankort is not supported by SecurePay, but uses Secured by Nets instead.

In order for Secured by Nets to be processed, a valid shop url has to be inserted in the manager under settings > merchant. This url may not contain the characters æ, ø and å.

Secured by Nets will not work if the time zone e.g. is set to Atlantic Time (-4:00) under Settings -> Merchant. The time zone has to be Copenhagen time (GMT +1:00).

1-click-payments/MobilePay Online

Solutions that uses 1-click-payments, or other token-based solutions like MobilePay Online are not a subject to SecurePay, and will therefore continue as normal.

Step-by-step guide for international cards

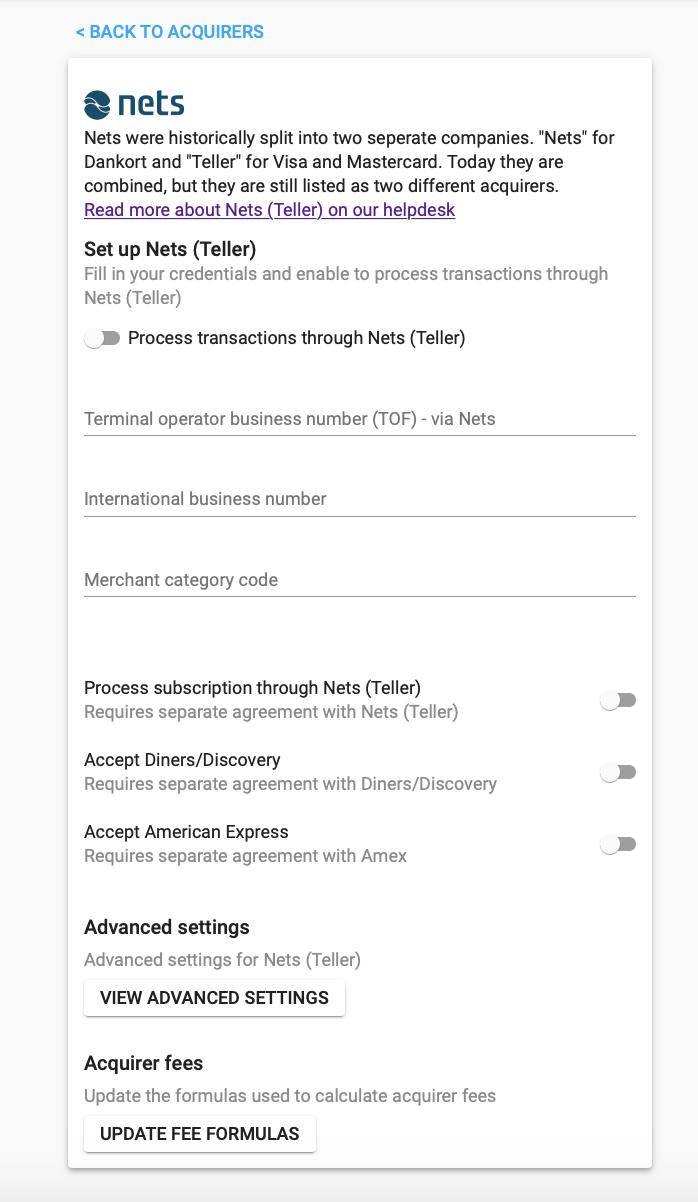

Here you will need the business number for Visa, MasterCard… And then insert into the Quickpay Manager under Settings > Acquirers > Teller in the field named International business number.

The “Terminal operator business number” is to be inserted in to the field named Terminal operator business number (TOF)

And the “Merchant category code” goes in the field Merchant category code

If you also want to accept American Express, activate the button “Accept Amex” (This requires a seperate agreement with Nets).

Lastly click Process transactions through Nets (Teller), you are now ready to accept payments through Teller.

Read more on Merchant not participating.

If you get in the situation where you need to do a partial capture where the final capture is the same amount as the first. Then our system shows OK as this is the message we get from Nets. This however is incorrect, Nets have admitted to the error from their end. There is no ETA on a fix for this error. If you experience this scenario, then you should contact Nets as they will be able to do a manual capture from their end.

Our experience with this issue tells us that, if you wait 24 hours before doing the final capture, it works.

Nets business service

If you have questions regarding your payments or payouts, you need to contact Nets business service Phone: +45 44 89 24 80

Nets Contractservice

If you have questions regarding your application, you need to contact Nets Contractservice Tlf: 44 89 29 30

Read more about Nets on https://nets.eu