An acquirer agreement is an agreement between you and the desired acquirer. An acquirer agreement with Clearhaus enables you to accept payments by Visa/Dankort, Visa, Visa Electron, Mastercard, Mastercard Debit and Maestro.

Apply for an Clearhaus agreement on https://apply.clearhaus.com

It is of course possible to accept recurring payments (subscriptions) through Clearhaus. No extra application is needed – but Clearhaus will need to activate it on your agreement though.

It is also possible to make payouts through Clearhaus. This will enable you to transfer funds to cards, you don’t already have accepted payments from. Clearhaus will need to activate it on your agreement through.

It then needs to be activated on the Quickpay Manager.

The payout feature is named “Credit” with Clearhaus

The price for making a payout to a creditcard i €3 per transaction.

When Clearhaus approves your agreement, they handle the signup for 3-D Secure for both VISA and Mastercard.

Please note, that there can go up to 10 days before Mastercard activate your account for 3-D Secure.

Each Clearhaus account has a set of Transaction rules from Clearhaus. This can e.g. be a maximum amount that can be processen in a given period, or that all payments must go through 3-D Secure.

After filling in the Clearhaus API Key in the Quickpay Manager, click on [See account info] to see your rules.

Some merchants will get payments rejected by Clearhaus with an error message of “not fully 3dsecure”. “Not fully 3dsecure” means that the cardholder has not confirmed their identity in the 3-D Secure flow. Reasons for this includes that the card issuer does not support 3-D Secure or has a temporary problem on the 3-D Secure service.

You can check if a payment has been “fully 3dsecure” on the 3-D Secure Status. 3-D Secure Status = Y means that the cardholder has been “fully” through 3-D Secure.

On the specific rejected payment there is unfortunately nothing we can do. I some cases it will be possible to contact Clearhaus, and hear about the possibility of removing the rule or adjust to only require “some 3dsecure”.

Log in to the Quickpay Manager on manage.quickpay.net

Go to Settings > Acquirers > Clearhaus

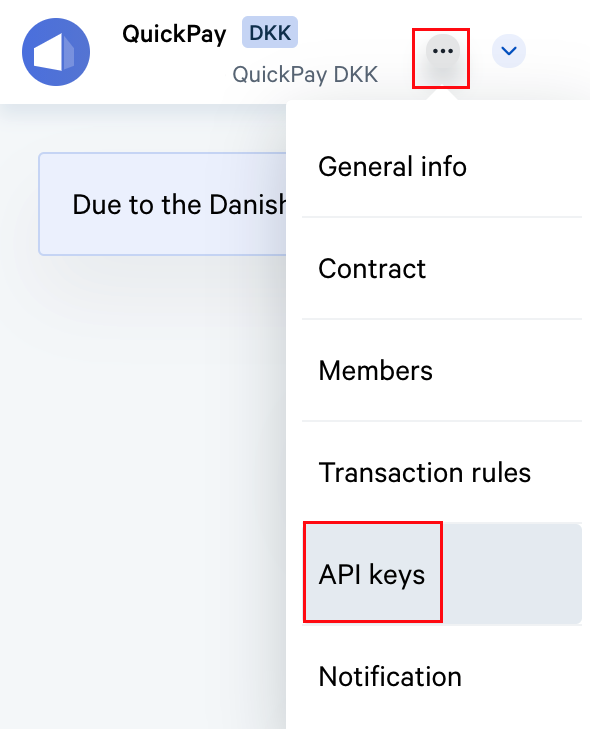

Now go to clearhaus.com, log in and click the settings icon in the top left corner next to your shop name, now select API keys.

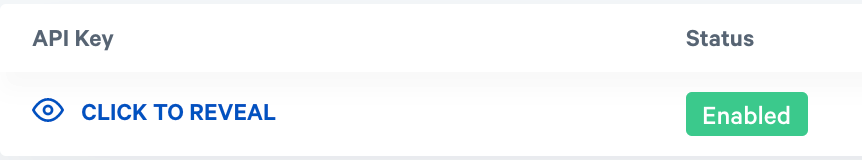

Now click the Click to reveal icon and copy the key

Jump back into the Quickpay manager and paste your Clearhaus API Key into the API key field, and enable the Clearhaus acquirer. Once your key as been pasted in you will see a See account info button, when clicking this button your agreement data including transactionrules are revealed.

The order id you send to Quickpay shows in Clearhaus in the field Reference.

You can find a list of error codes from Clearhaus on their website

It’s possible to configure multiple Clearhaus API Keys on a single Quickpay account.

Each API Key in Clearhaus is associated with a specific settlement currency. To receive settlements in various currencies, it’s necessary to obtain additional Clearhaus API Keys.

After acquiring one or more Clearhaus API Keys, they can be integrated into the Quickpay Manager under Settings > Acquirers > Clearhaus.

In the “Additional Settlement Currencies” section, you can append extra keys by entering the key and its corresponding currency.

Subsequently, any new transactions in the specified currency will be processed through Clearhaus using the respective API Key. Transactions in other currencies will be processed using the default Clearhaus API Key linked to your account.

The Clearhaus Merchant ID used for transactions can be viewed on the transaction detail page in the Quickpay Manager or within the `metadata.ch_mid`` field in the JSON output.