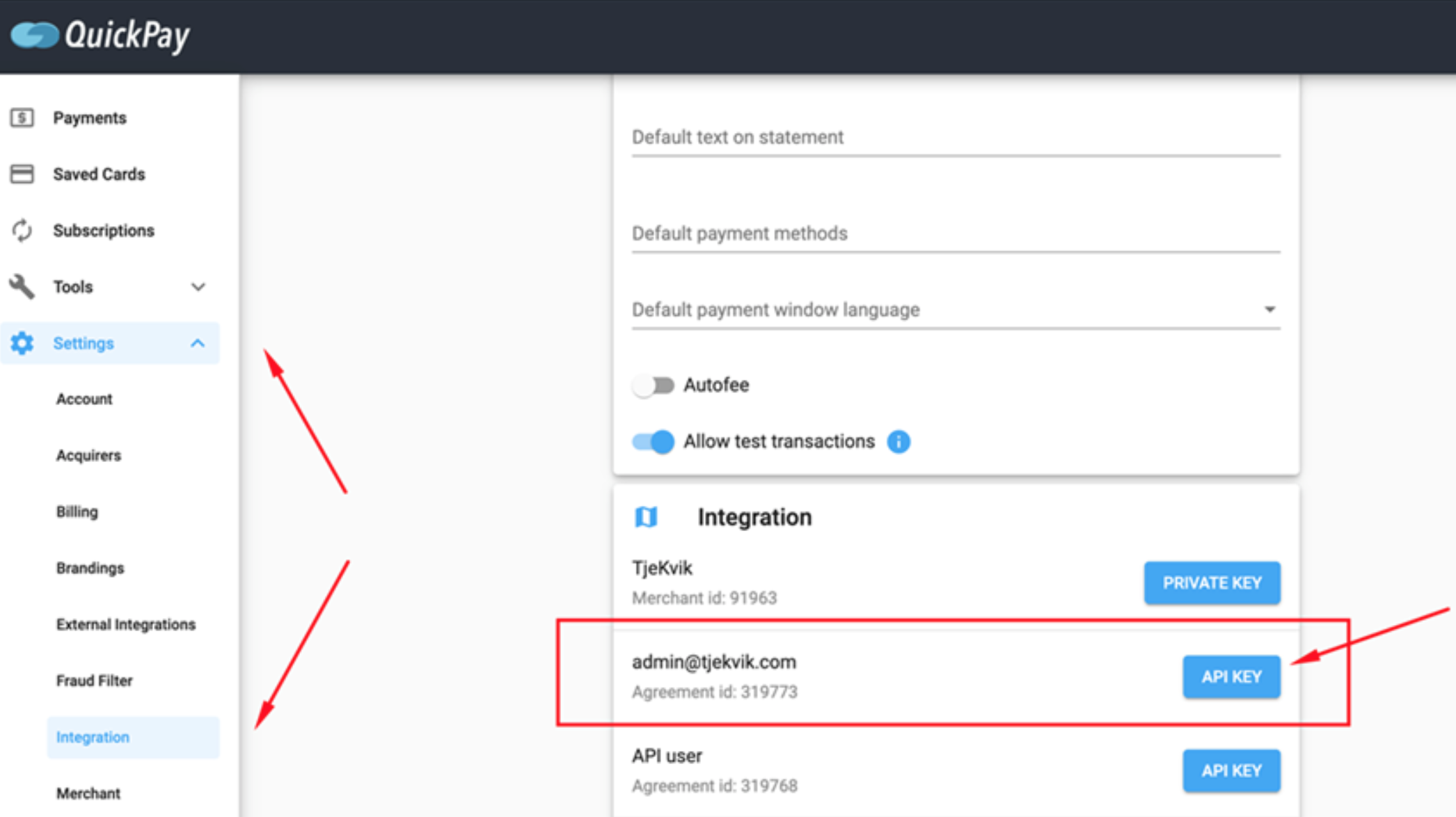

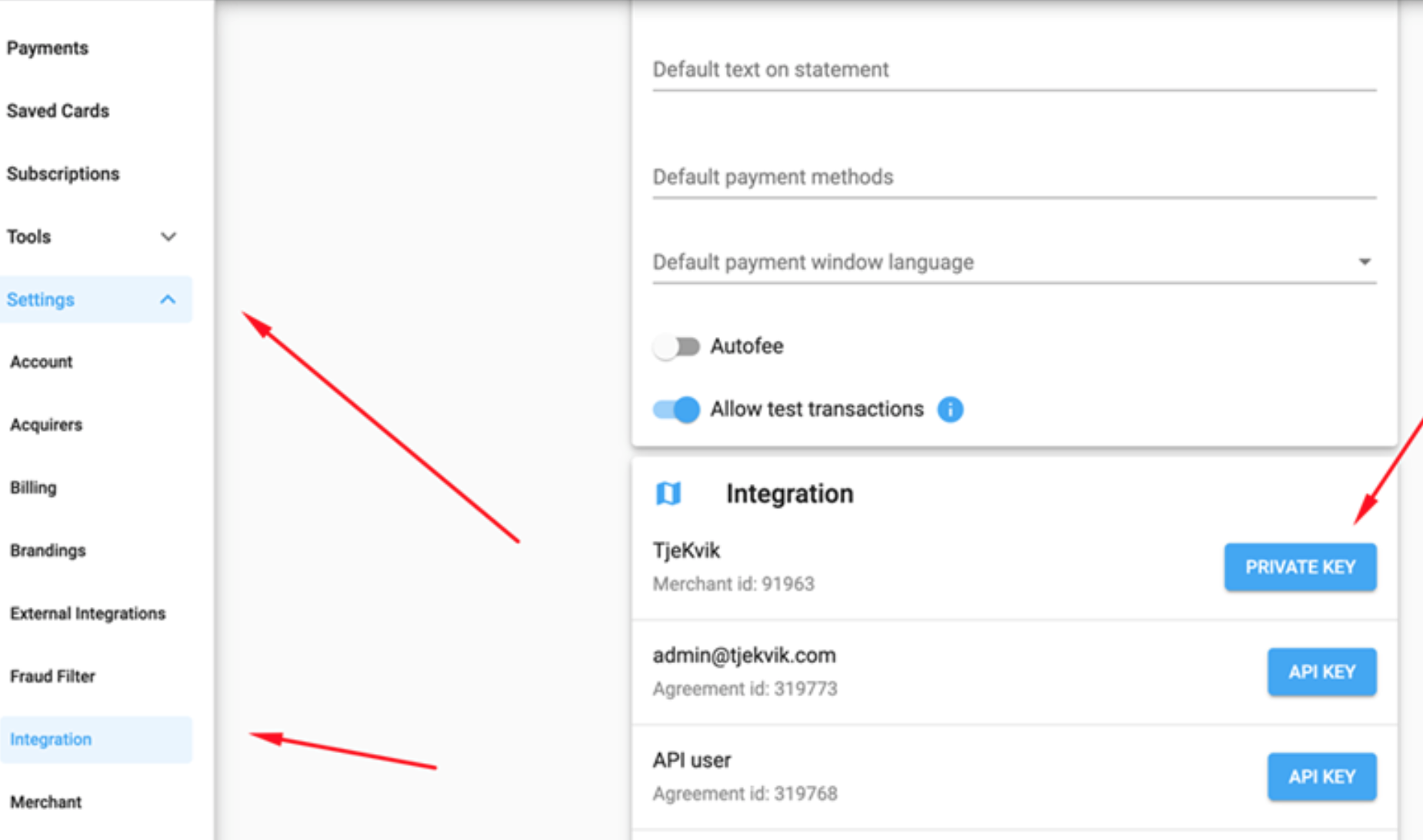

Quickpay integration with TjekVik makes it easy to get started with accepting online payments.

Tjekvik is the #1 provider of self-service solutions for ambitious dealer groups and brands worldwide. We enable dealerships to optimise their processes in the aftersales journey with software and hardware solutions across home, indoor, and outdoor.

Visit www.tjekvik.com for more information about the system.

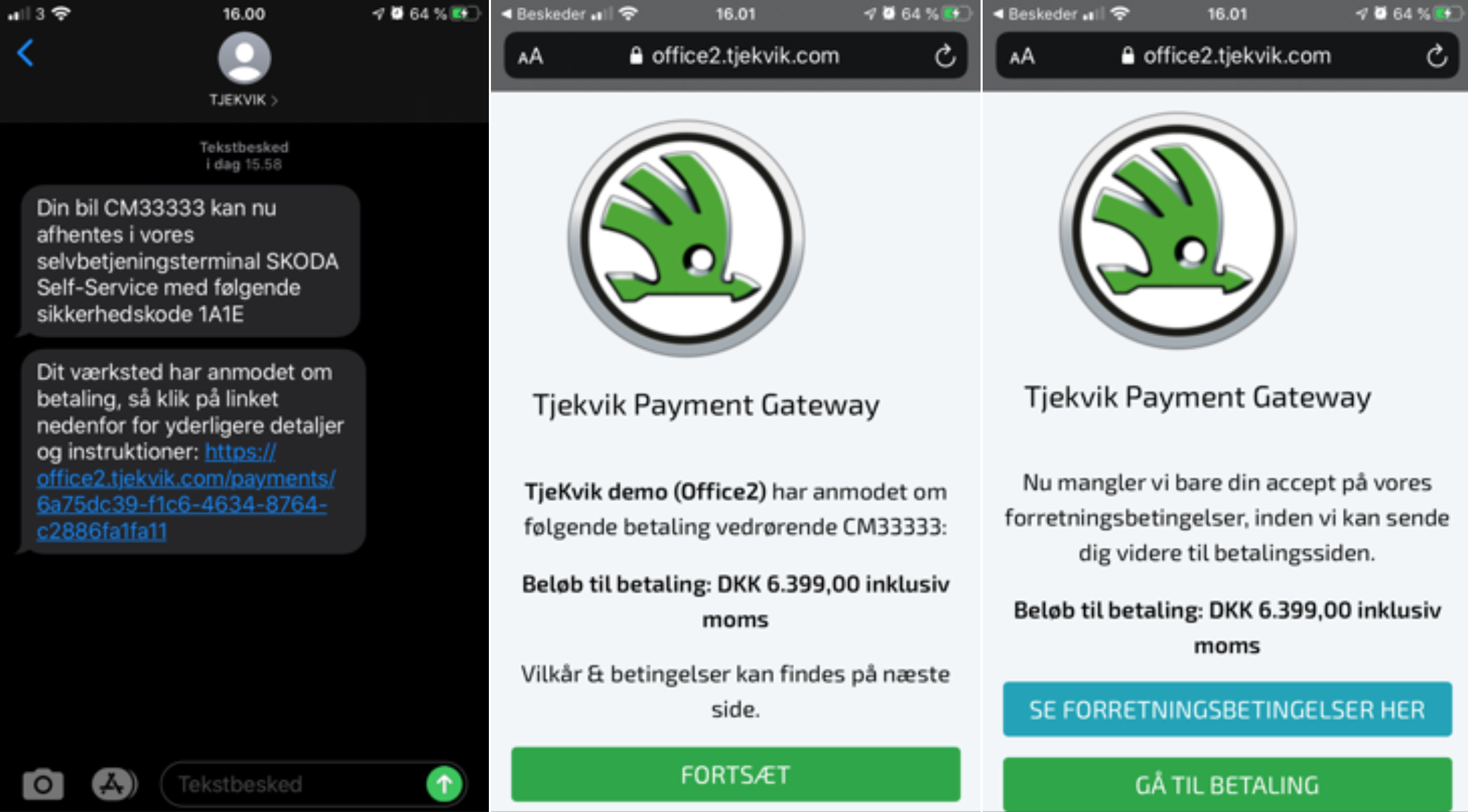

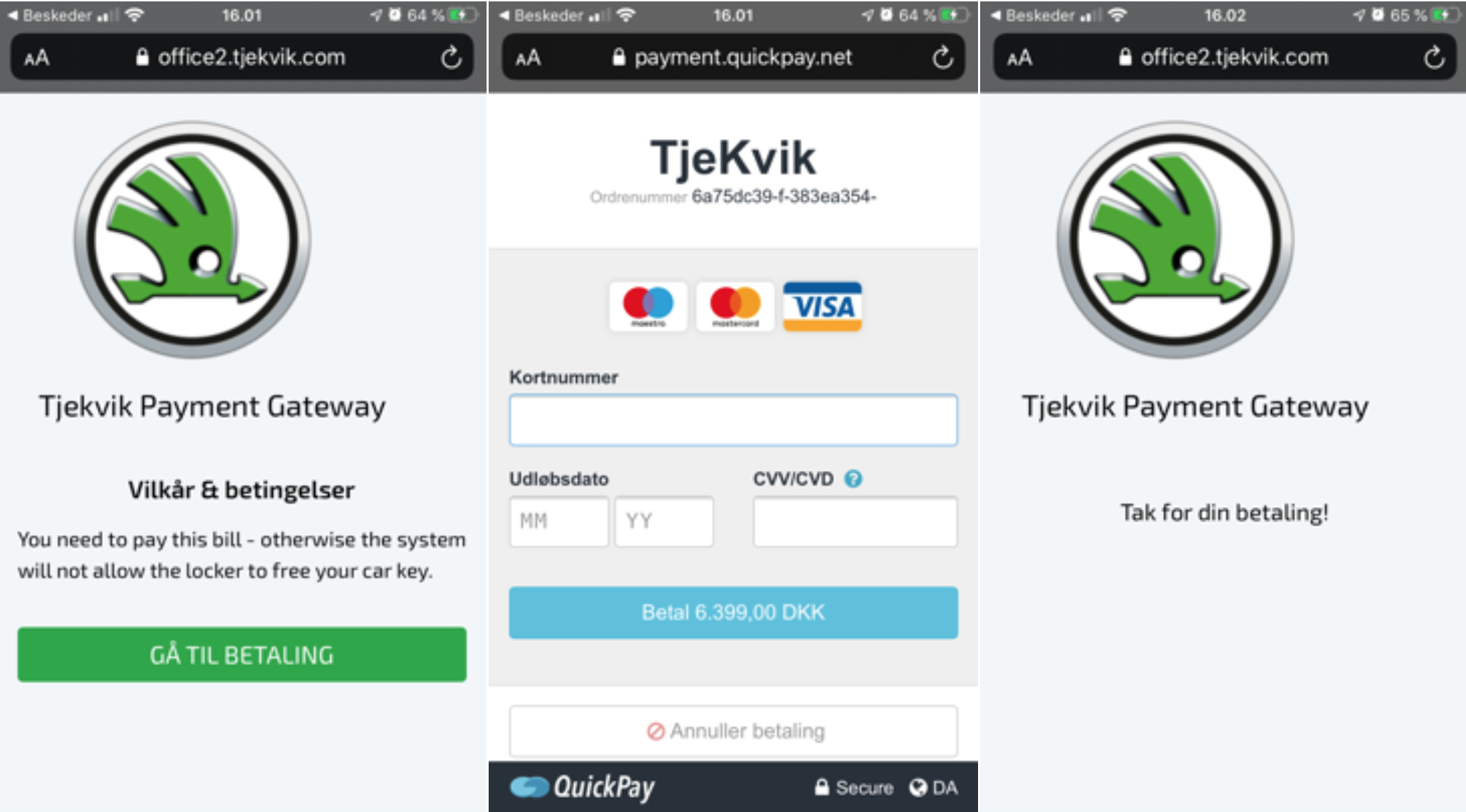

Tjekvik is the leading provider of self-service solutions to ambitious dealer groups and car brands worldwide. We enable resellers to optimize their after-sales processes with software and hardware solutions that can be used by customers from home, as well as indoors and outdoors upon arrival at the reseller.

TjeKvik’s payment solution is only offered to customers who uses TjeKvik’s software. The solution is a combination of: TjeKvik software

If you have further quistions, you can allways contact the following persons:

Please note! Use of the integration is at your own risk, and we only provide limited support on installation and usage of the integration.