Quickpay allows you to accept payments with MobilePay Online.

MobilePay Online is a payment product designed for use with mobile devices. It works in both the real physical world and on the internet. With a simple swipe the customer can pay with their MobilePay app no matter which device the order is being processed from.

Advantages

MobilePay for ecommerce is called MobilePay Online.

The customer can in the shop or payment window select MobilePay Online as the payment method, and instead of filling in their card information, the payment is completed in MobilePay.

MobilePay Online works with the following currencies:

A payment card is attacted to the customers MobilePay account. When a MobilePay payment is completed, the payment card information is directed from MobilePay to Quickpay and then to an card acquirer. Just like in a regular card payment.

A card acquirer agreement is required to use MobilePay Online, and you can only accept the cards through MobilePay, that your acquirer agreement covers.

It is possible to use MobilePay with all acquirers through Quickpay. In some cases, it is however required that the acquirer enable it on your agreement.

It is not possible to add auto-fee for business cards on MobilePay payments. We as the gateway, do not know the card type, before the payments are sent to MobilePay. And MobilePay does not support that the fee is added to the payment.

You are not required to have an agreement with MobilePay to use MobilePay Online. MobilePay Online is invoiced through Quickpay.

MobilePay Online costs 49 DKK per month + 1 DKK per transaction in addition to the acquirer fee and regular Quickpay transaction fee.

You can enable MobilePay Online in the Quickpay Manager in Settings > Acquirers > MobilePay Online

MobilePay requires an uploaded logo to accept payments through MobilePay Online.

You can uploade the logo in the Quickpay Manager during the setup.

The logo must be a png-file and with the size of 250px * 250px

In most cases MobilePay Online will automatically show in the payment window when enabled in the Quickpay Manager.

If you specify which payment methods and payment cards that are shown in the payment window, you will need to add MobilePay to this.

This is simply done by added “mobilepay” to the payment_methodsparameter.

This example shows payment cards and mobilepay as the options in the payment window.

payment_methods = creditcards,mobilepay

When you are setting up your shop, you will also have to take the following in mind, if your customers will pay with MobilePay Online through a mobile device.

a) If the entire flow is made from a mobile device, and the customer are using a browser that is not the standard browser, MobilePay redirects the user back to the continue_url in the mobile standard browser. The order confirmation page will therefore need be working without other data (e.g. a cookie) than what is included in the redirect.

b) In some cases the user will not return from the MobilePay app, so your flow must not be dependent of the user returning to your confirmation page.

Please note that it is not yet clear if MobilePay Online will count as Strong Customer Authentication after PSD2 goes into effect

If you are required by your acquirer to use 3-D Secure, or other Strong customer authentication, on all of your transactions, you may have some issues with accepting MobilePay Online. The solution to the issues depends on which acquirer you are using.

It is important, that you as a merchant are aware that with MobilePay Online, you do not get the liability shift (that is provided with 3-D Secure). This means that financial liability in case of fraud does NOT shift to the card issuer, but stays with the merchant.

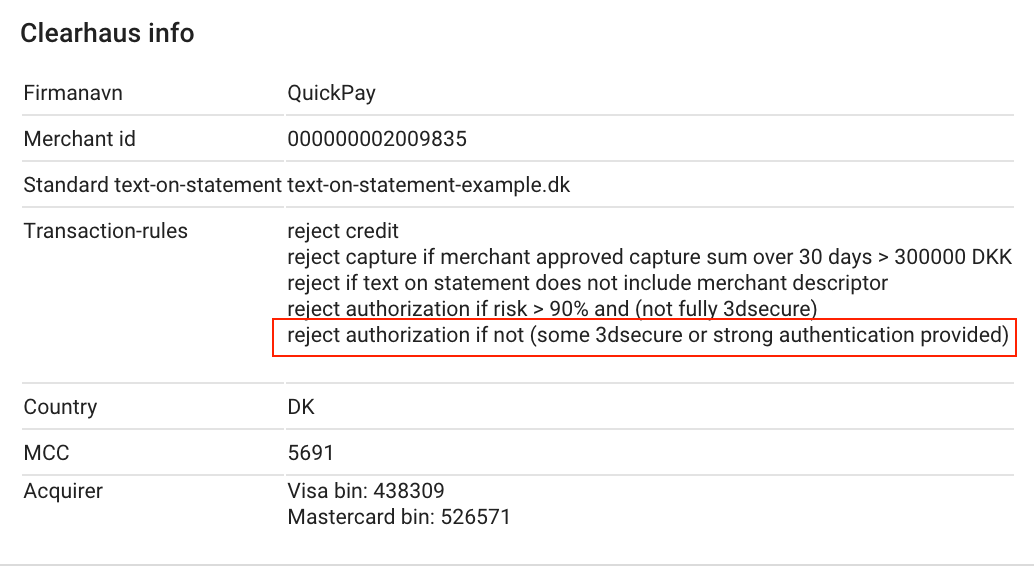

You can see your Clearhaus-rules in the Quickpay manager under “Settings -> Acquirers -> Clearhaus -> See account info”.

If Clearhaus requires 3-D Secure on your transactions, they have given you are rule like:

reject authorization if not (some 3dsecure)

It needs to be expanded to also include MobilePay to something like:

reject authorization if not (some 3dsecure or strong authentication provided)

You need to contact Clearhaus directly to ask if they are willing to change your rules about MobilePay Online. You can contact Clearhaus on mail at support@clearhaus.com - remember, to state your customer id with them in the email.

Would you like to accept MobilePay payments in your Shopify solution? Have a look at our Shopify guide.

It is currently not possible to use subscriptions through MobilePay Online. However, Quickpay will soon launch support for MobilePay Subscriptions.

Read more on MobilePay Subscriptions