The trend is clear. Payment methods requiring the fewest possible inputs and clicks undoubtedly win customer favor. When Danish consumers shop online, we increasingly pay with mobile wallets like MobilePay, Apple Pay, and Google Pay rather than reaching for the physical payment card.

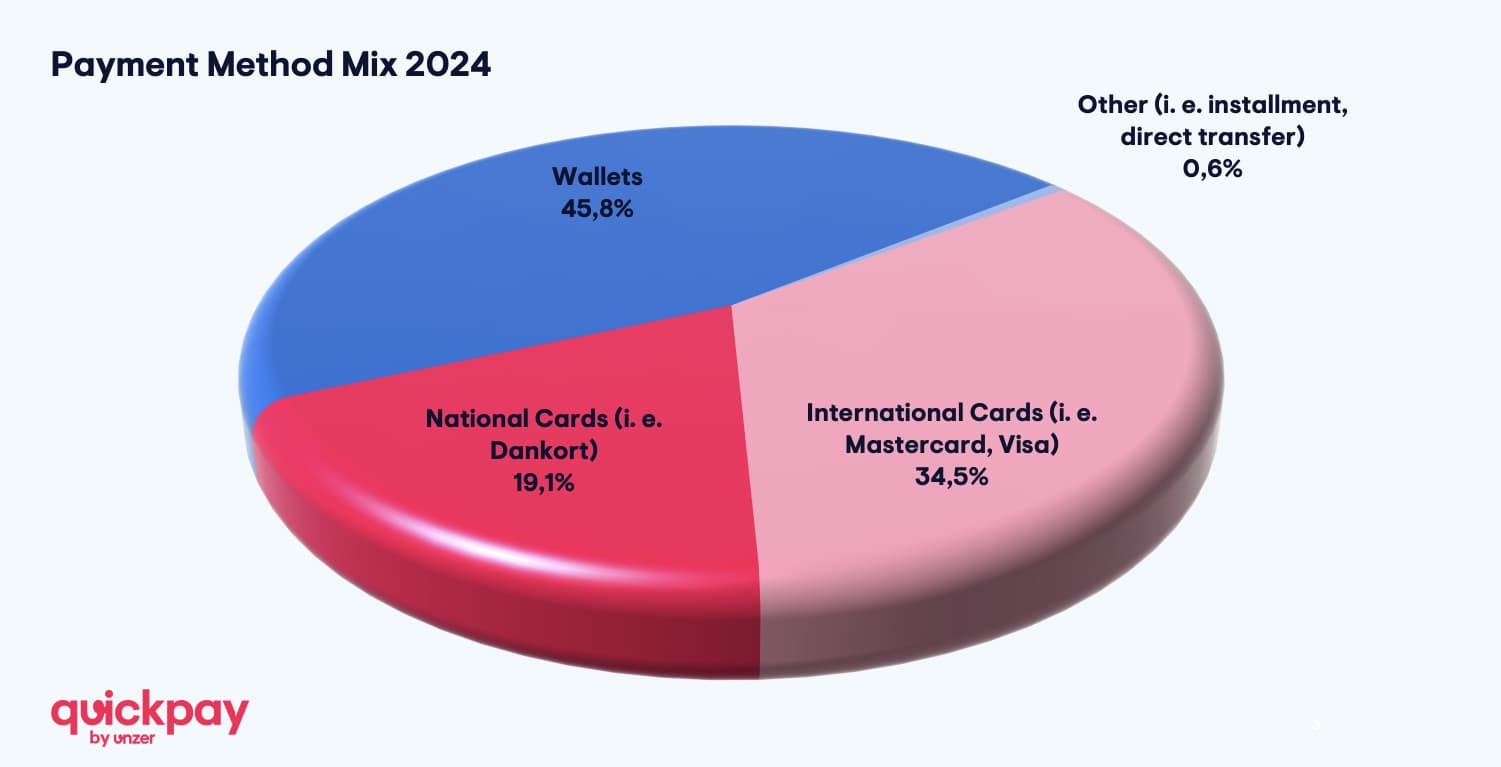

According to the Quickpay Index, calculated from all transactions across the 30,000 affiliated webshops in September 2023 and September 2024, 45% of sales volume is via MobilePay, Apple Pay, and Google Pay. International cards accounted for 35% of sales volume, national cards, primarily Dankort, represented 19%, and 1% came from BNPL (buy now, pay later) and installment payments.

Know your customers’ payment patterns

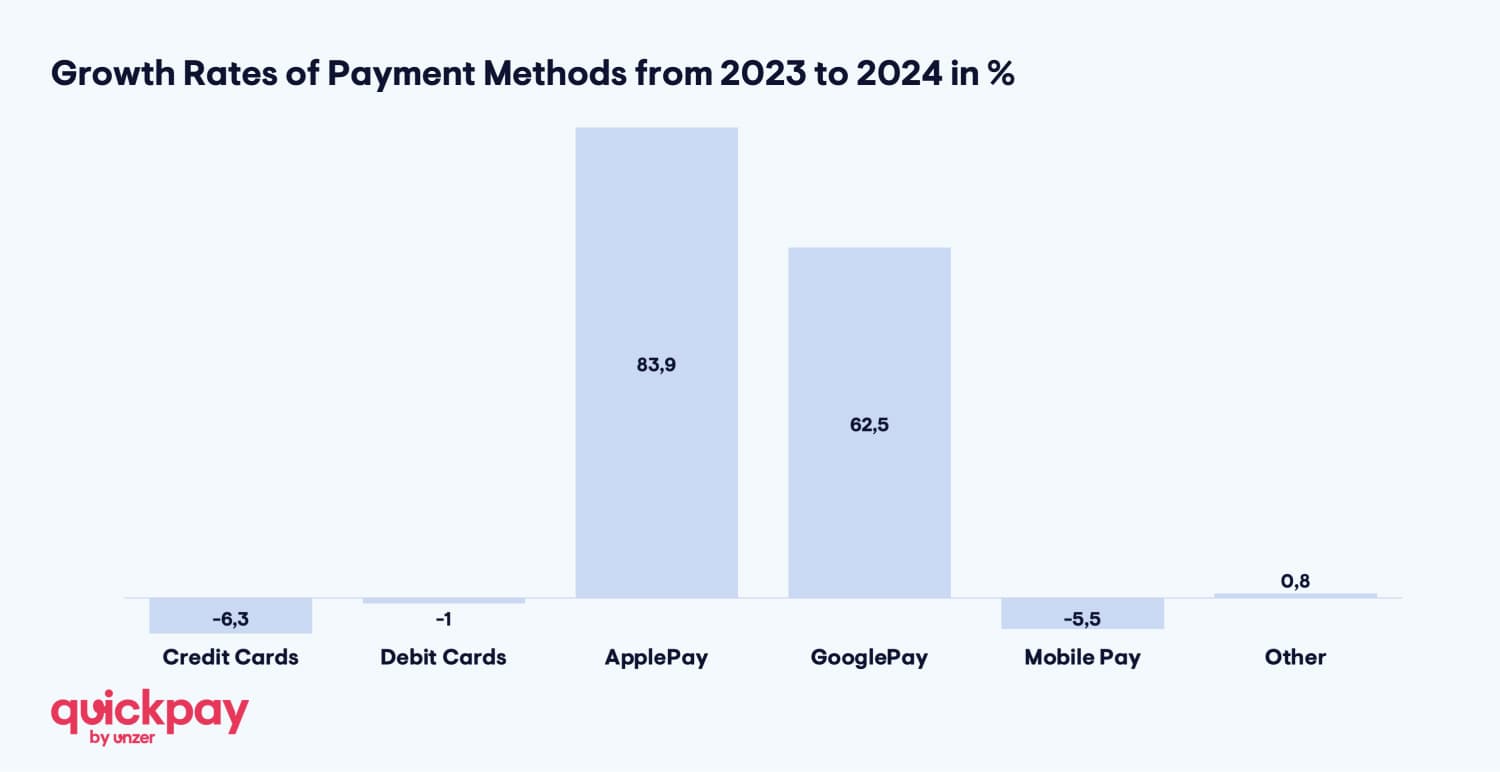

Between September 2023 and September 2024, the share of payments made via Apple Pay and Google Pay has increased by 84% and 62%, respectively. If you run a webshop, you should expect an even greater share of online sales from mobile wallets in the future, and new mobile wallets will continue to be introduced.

Here are some key facts based on the Quickpay Index for September 2024:

- The share of payments made with Apple Pay - regardless of the linked card - has risen by nearly 84%.

- The share of payments made with Google Pay - regardless of the linked card - has increased by 62%.

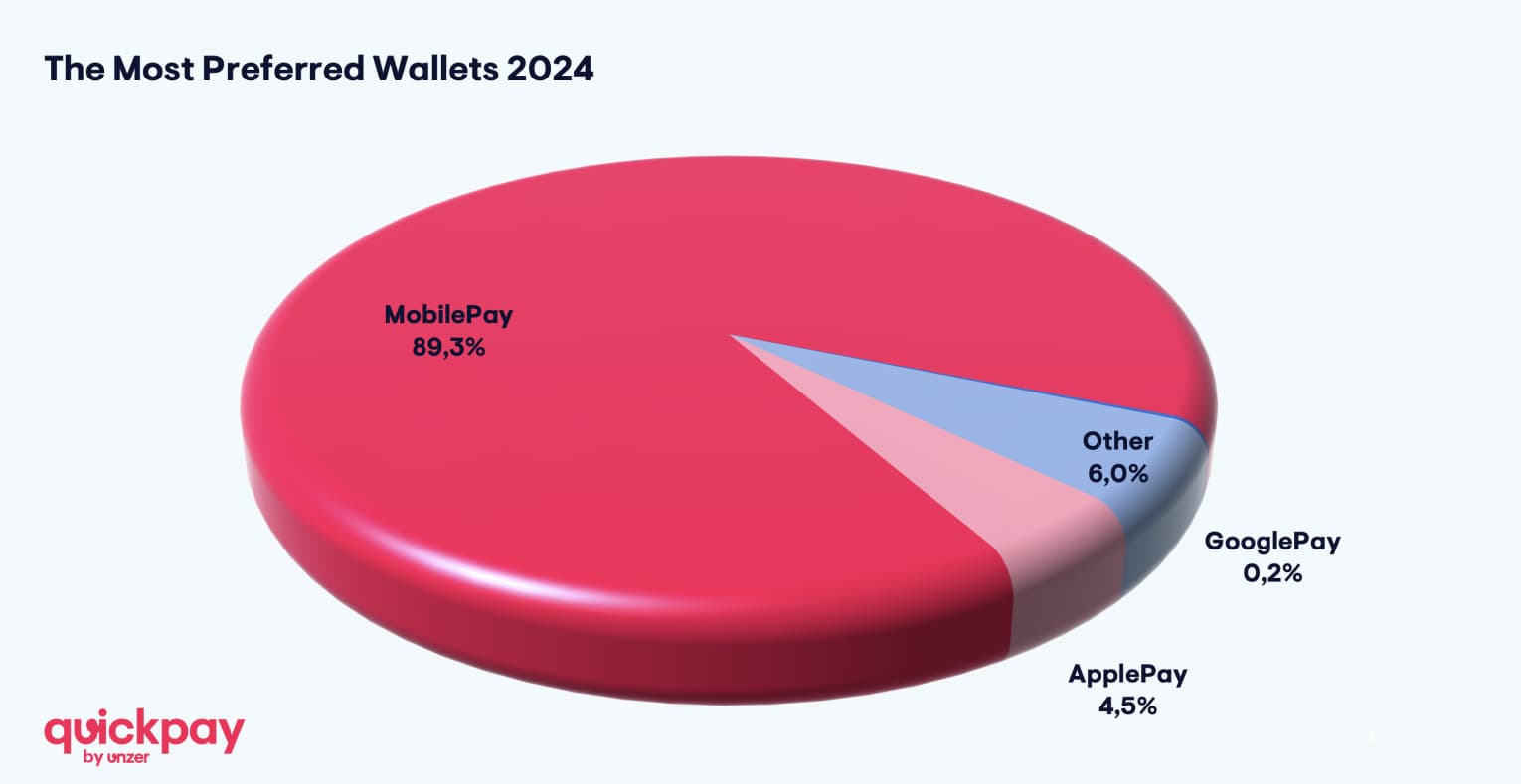

- MobilePay, linked to both international and national cards, stands out with an impressive high sales volume in the triple-digit millions (EUR). However, sales volume decreased by 5% from 2023 to 2024.

- Payments with MobilePay linked to Dankort have declined by nearly 8%.

- Payments with the physical Dankort have decreased by nearly 7%.

- Payments with physical cards - both credit and debit - have fallen by 7%.

- Comparing individual payment methods, including both credit and debit cards, Dankort still leads in volume, both as a stand-alone card and when linked to MobilePay.